Easily donate the full appreciated value of your crypto to Carbon Offsets To Alleviate Poverty (COTAP), the climate change and poverty alleviation nonprofit! We’re a registered IRS 501(c)3 public charity, which means you’ll be avoiding capital gains taxes and getting a possible tax deduction. Equally as important, you’re also offsetting emissions, taking responsibility for your contribution to climate change, and changing lives! Our press release about accepting crypto can be found here and our rationale can be found here.

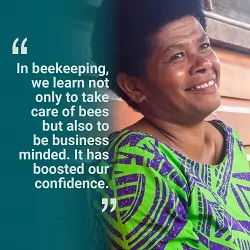

90% of net proceeds goes to our partners – community-led forest carbon projects which protect and restore landscapes while creating life-changing income for rural communities in Uganda, India, Fiji, and Indonesia. All projects are certified by Plan Vivo, the world’s oldest forest carbon standard, as well as 3rd-party verified every 5 years.

We’ve partnered with Every.org, a leading crypto donation solutions provider which ensures your donation is IRS-compliant, so that you don’t receive a surprise capital gains tax bill and so that you can possibly get a tax deduction for your donated crypto.

How it Works

- Use the widget on this page to donate Bitcoin, Ethereum, and other major cryptocurrencies.

- In the “Donation notes” field, tell us how you’d like the proceeds to be used:

- “All Projects”: Offsetting to all COTAP Projects (Projects receives 90% of net proceeds, COTAP receives 10%),

- “[Country goes here]”: Offsetting to one specific project in Uganda, India, Fiji, or Indonesia (Project receives 90% of net proceeds, COTAP receives 10%), or

- “COTAP operations”: Under this option, your emissions are not being offset. 100% of net proceeds go towards supporting COTAP’s our operations, and expansion.

Important Notes

- For tax purposes, please use your receipt and donation value provided by Every.org, not the offsetting acknowledgement and net amount received by COTAP.

- While this program is primarily intended for U.S. residents, anyone may donate cryptocurrency to COTAP.

- You may also donate cryptocurrency by setting up a Fidelity Charitable Donor Advised Fund (DAF) and then sending a grant to COTAP from the DAF.

- Per our Terms of Use, 100% of donations which are anonymous AND lack an offsetting designation will be utilized for our operations and expansion.

- Other questions? Please see Every.org’s FAQ and/or contact us at info at cotap dot org.

Employer Matching

- Use the Double the Donation tool below to see if your employer matches donations.

- Per our Terms of Use, 100% of employer matching funds will be used for COTAP’s operations and expansion. This helps us keep our margins (10%) uncommonly low, consistent, and transparent.

More About COTAP & Cryptocurrency

Because cryptocurrency is treated as an asset by the IRS, it is subject to capital gains taxes (if it has appreciated in value since you purchased it) when it’s sold or used to purchase something. So, you can’t use appreciated crypto to buy offsets from a U.S. for-profit offset provider without incurring capital gains. COTAP, a 501(c)3 nonprofit, is exempt from capital gains taxes. This means that not only can you efficiently transfer the full, appreciated market value without a tax penalty, you can also claim it as a tax deduction.

For those seeking to donate crypto, we are a unique and compelling option because the majority today’s cryptocurrency sits at the confluence of carbon emissions and disposable wealth, and COTAP sits at the confluence of climate change mitigation and poverty alleviation. Learn more about our rationale for accepting cryptocurrency here.