$15 per tonne | 90% goes to projects | 100% U.S. tax-deductible

DAF Options

- For Fidelity Charitable, Schwab Charitable, or BNY Mellon please use DAF Direct.

- For other DAF’s, please use Every.org. Every.org DAF donations are processed by Chariot and entail a 2.9% fee, which is covered by COTAP’s 10% margin.

- Every.org prompts donors to add an optional 15% to support them. For example, if you donate $1,000 and add their suggested 15%, then you’d be donating $1,150 and offsetting 66.67 tonnes ($1,000 ÷ $15/tonne). Regardless, the entire amount is tax-deductible.

- If your DAF is not listed with DAF Direct or Every.org, you can still donate by providing COTAP’s charity number 27-4220630.

- If you don’t yet have a DAF, folks like Daffy seek to make it as easy as possible to set one up.

Instructions

- Offset any dollar amount at right (below if mobile/tablet). If you know your carbon footprint, multiply by $15/tonne. If you don’t, it’s also fine to enter a dollar amount and we’ll do the rest.

- To offset evenly through all COTAP projects, the donation/grant “Designation” should be “Offsetting: All Projects.”

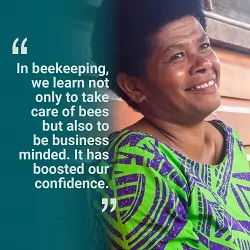

- To offset to one specific project, the “Designation” should note the country of the chosen project – Uganda, India, Indonesia, or Fiji e.g. “Offsetting: India.”

- For donations without an “offsetting” designation, 100% goes to COTAP’s operations and expansion. This includes donations intended as general COTAP support, with designations such as “wherever it’s needed most.”

- If you have trouble specifying your designation, please email us at info@cotap.org to ensure that your donation is applied according to your wishes.

- To receive an official offsetting acknowledgement from COTAP, you must include contact information.

Additional Information

- COTAP’s a 501(c)3 public charity and our EIN is 27-4220630.

- COTAP’s audited financials are available upon request. Email us at financials@cotap.org.

- For donations made during the year-end giving season, COTAP may not receive your donation/grant until after December 31st. For tax reporting purposes, please use your official DAF receipt, not your COTAP offsetting acknowledgement.

Where Your Money Goes

If contact information is provided, you will receive a detailed offset acknowledgement like this one. Your tonnes will be included in our public carbon credit retirements on the Markit Environmental Registry like this. You can track COTAP’s progress and download projects’ annual reports, which contain detailed accounting of payments to communities, in our Transparency section.